Cryptocurrency is stored in a digital wallet, a secure environment that stores the private keys you need to get to your bitcoin and other crypto. This digital wallet facilitates your activity on the blockchain, which is how most crypto transactions are recorded.

There are two types of digital wallets to choose from, each of which has important advantages and drawbacks you need to consider when buying bitcoin and other crypto. What are hot wallets and cold wallets, and what are the major differences between these digital wallets? Read on to find out.

What is a hot wallet?

A hot wallet is a digital wallet that’s connected to the internet. This wallet can work on different blockchains, allowing you to buy, sell, and exchange bitcoin and other crypto from one convenient location. If you have bitcoin and other crypto at the ready to use at any time, this amount is typically kept in a “hot wallet,” because hot wallets are much easier to access and use than their cool counterparts. A good way to think about a hot wallet is: only store as much crypto in a hot wallet as you would carry in physical cash in the wallet in your pocket.

How does a hot wallet work?

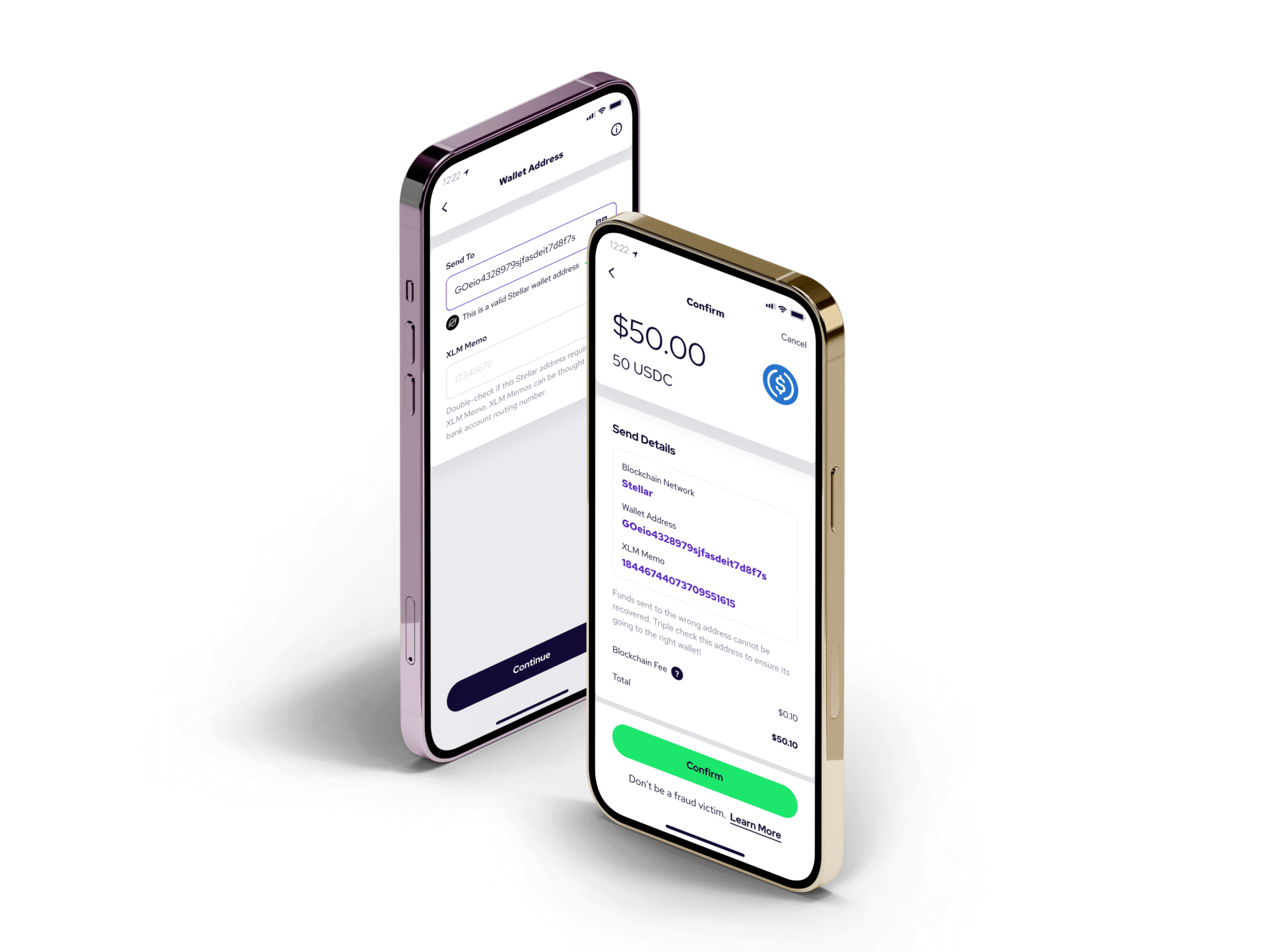

A hot wallet works by initiating, signing for, and authorizing financial transactions digitally. With a hot wallet, both your public key, which is your wallet’s address, and your private key, which is your set of personal credentials to log into your hot wallet, are stored on the internet. This allows access from any internet enabled device to buy, sell, and exchange crypto like bitcoin. Web-based wallets, app-based wallets, and desktop wallets are often hot wallets.

Pros and cons of a hot wallet

Accessibility is the biggest advantage of a hot wallet. The crypto contained in a hot wallet can be withdrawn on demand, so it can be used quickly in everyday transactions between the owner and the end user. That’s because the server can be accessed by anyone holding the credentials, from any internet connected device.

For all the convenience hot wallets offer, they come with more security concerns. A hot wallet’s internet connection makes it inherently more vulnerable to hackers. Choosing a safe and reputable provider for a hot wallet, as well as having a strong password with Two-Factor Authentication, is critical in protecting your assets.

What is a cold wallet?

A cold wallet is a digital wallet that’s not connected to the internet. Also called cold storage, a cold wallet’s private key — your credentials to get into the wallet — are not stored online. Cold wallets require physical possession of or access to the wallet to use the crypto contained within.

How does a cold wallet work?

Similar to a hot wallet, a cold wallet contains the private keys required to use the digital currency associated with those credentials. However, without internet access, cold wallets are more secure. Each transaction needs to be “signed” with the private keys stored offline. To use a cold wallet, you’ll only need to be connected to the internet during the time of a transaction, which greatly increases the security.

Pros and cons of a cold wallet

Cold wallets are considered more secure because they are much harder to access than their hot counterparts. This also makes it much harder for wrongdoers to gain access to your crypto. For this reason, many crypto buyers will hold most of their bitcoin and other digital currency in a cold wallet. But that security comes at a trade-off: It’s much harder to use this kind of crypto in everyday transactions and the user needs to bear responsibility for their private keys.

Hot wallet vs. cold wallet: Which is right for you?

Most bitcoin holders will use a mix of hot wallets and cold wallets. Generally, a much smaller amount of bitcoin for everyday transactions is kept in a hot wallet for accessibility, while a cold wallet holds the bulk of your crypto in a more secure space away from potential hackers and intruders. Think of it like a traditional checking account versus long-term savings: You can quickly use the funds in your checking account with your debit card, but a long-term savings account like a CD may have significant restrictions and take lots of effort to access the money they contain. While not perfectly analogous, they can help illustrate use cases for each digital wallet type.

Convert cash to bitcoin with Coinme

At Coinme, we’ve simplified bitcoin buying through our nationwide network of bitcoin kiosks and other locations! At a Coinme kiosk, you can exchange up to $2,500 cash to bitcoin each day. Once put through the machine, you’ll receive a voucher which you take home to redeem and store in your wallet. Use your new bitcoin at any time! To get started, visit the Coinme website to find a kiosk near you and set up your complimentary digital wallet.